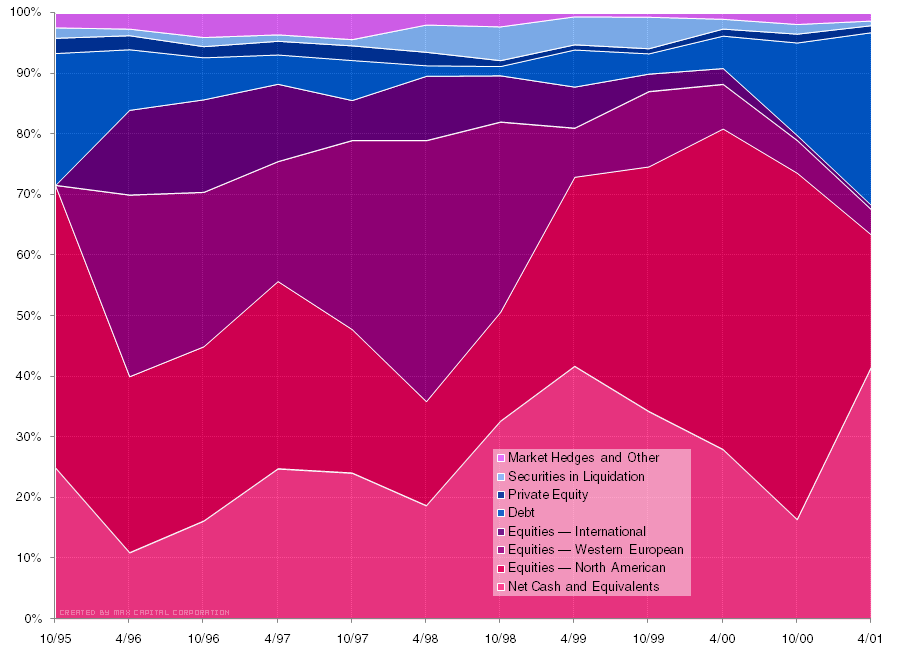

Baupost Fund Allocations: 1995-2001

A few months ago I helped put together a PDF of Seth Klarman's letters to investors of the Baupost Fund from 1995 to 2001. Among many other great discussions, Klarman goes over a few of his individual holdings and Baupost's rationale for investing.

One interesting aspect of Klarman's investing style is his allocation into many asset classes. By not limiting himself to one asset class, he is able to hugely increase his universe of investments and also mitigate the risk of a single market class collapsing. If public equities are generally overvalued, corporate bonds, treasuries, private equity or real estate may provide better returns. It is also well known that Klarman doesn't hesitate to hold a lot of cash when he can't find any good investments.

In this post, I'd like to examine the investment allocations of the Baupost Fund from both a numerical and qualitative perspective. (Keep in mind that the letters from above are from only one of Baupost's smaller funds, but my guess is that the allocations are very similar to those in the main fund.)

Let's take a look at the investment categories:

Cash and Equivalents (net of any payables)

Equities -- North American

Equities -- Western European

Equities -- Other International

Debt: Bonds, Bank Debt & Trade Claims, Collateralized Mortgage Obligations, Municipal Bonds

Private Equity: Stakes in private partnerships or businesses

Securities in Liquidation: Both liquidating trusts and equity/debt in liquidation

Market Hedges & Other: Call and put options, Warrants, Rights

In his letters, Klarman breaks Baupost's investments into other categories, such as "Arbitrage or Spread Trades." However, since these (and some of the other categorizations) are based on qualitative judgments, my analysis uses only the categories listed in the official Schedule of Investments.

Click here for a spreadsheet with the above figures.

Some Observations

The Baupost Fund is more diversified than a typical value investor, but it is more concentrated than most mutual/hedge funds. Baupost doesn't have targeted asset allocations, but moves into different asset classes opportunistically based on where the best bargains can be found.

Klarman keeps a sizable cash position for most of the period. In 2000, cash and debt holdings are decreased in favor of U.S. equities. This was the period during the bubble when small-cap equities were extremely cheap.

In addition to a large cash position, various market hedges are used as insurance against collapse. Puts on the S&P 500, Russell 2000, and Nasdaq indexes as well as a very small amount of out-of-the-money calls on Gold are used. It looks like Baupost also purchases these hedges opportunistically based on market levels and "cost" of insurance. Total hedges never account for more than 1-2% of the portfolio.

Klarman: "When we take a concentrated position, I'd say a dozen times over 26 years, we have had a 10% or so position." Over the above period, Baupost made only two 10%+ investments, one of which was a short: Security Capital Group, and Veritas Software Corporation (short).

A few other large investments (7-10%) were: El Paso bonds (1995), Chargeurs (1996-1999), TLC Beatrice International (1995-1999), Hudson City Bancorp (2000), and Finova Capital debt (2001).

Looking at the makeup of Klarman's portfolio, it may seem like he has unusually high turnover for a "value" investor (upwards of 100-200% in some years). However, I believe this is because his investing style is more like Graham's than Buffett's. There are three reasons I can think of for the higher turnover rate:

Focus on event-driven investments. With investments in equity, debt, and other alternative assets that are catalyst based, securities are held for a much briefer period. These include special situations like arbitrage, mergers, bankruptcies, restructurings and spin-offs. This allows Baupost to have less correlation to market returns.

Tangible assets are favored over intangible assets. Like Graham, Klarman focuses more on tangible asset bargains. He may take into account the value of intangibles (brand, franchise value, etc.), but for the most part Klarman believes it is easier to obtain a margin of safety with more certain asset values. Although not always the case, at times this means purchasing asset-heavy businesses with not-stellar returns on capital. Over time, these businesses will be forced to reinvest or payout their cash flow at paltry returns on tangible equity. If that equity is purchased at a significant discount, those returns could be great -- but not over the long-term. Hence, this investment type should have higher than normal turnover.

Willingness to sell an investment before reaching intrinsic value. Many value investors may purchase a dollar for fifty cents and sell that dollar for ninety cents or more. If it's a business, some investors may even hold that ninety cents while anticipating intrinsic value to grow over time. That's not necessarily a bad strategy, but Klarman seems to prefer buying a forty cent dollar and selling it in short order for sixty cents.