BreitBurn Energy Partners

I've owned BreitBurn Energy Partners (BBEP) both personally and through Braewick Holdings LP for the past year and a half. The following is a clip from my letter to partners explaining our investment in the company:

BreitBurn is an oil and gas production company structured as an MLP (see my July 2009 letter for a similar discussion of Linn Energy, another MLP). BreitBurn’s business model is fairly simple: their only job is to extract and sell oil and gas from wells they own throughout the U.S. These are wells they have acquired—they don’t take the risk of exploring or drilling for new wells. Basically, BreitBurn is like a portfolio of interest-only bonds—assets (petroleum in the ground) that pay interest (production revenue minus extraction and administration costs) until the bond is paid off (reserves are depleted). Here’s a quick summary of BreitBurn’s goal from their 10-K:

“Our objective is to manage our oil and gas producing properties for the purpose of generating cash flow and making distributions to our unitholders.”

Because BreitBurn wants fairly steady cash flow to fund their distributions, much of their oil and gas production is hedged. That level of hedged production is immune from fluctuations in energy prices. By the summer of 2008 when prices were high, they had managed to hedge about 70-80% of production for three years out. So when energy prices (and the stock market) subsequently collapsed that fall, BreitBurn’s cash flow remained mostly unharmed. However, as with many of the MLPs, Lehman Brothers was both counterparty to their hedges and a large owner of the stock. The “perfect storm” of falling energy prices, a crashing stock market, and Lehman’s liquidation caused BreitBurn’s unit price to fall from over $20 in the summer to under $6 in December.

When BreitBurn appeared on my radar in November, it seemed like the perfect example of a simple, profitable company that was being sold off by non-economic sellers. So despite all the market noise, what were units of BreitBurn really worth?

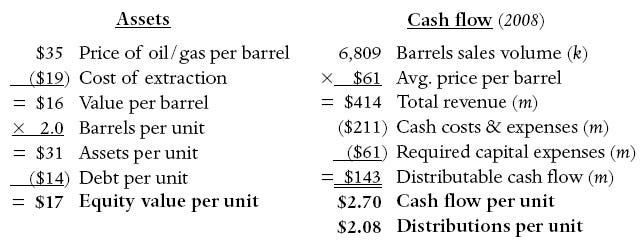

The above valuation of asset value is a simplistic method of obtaining the market value of oil and gas reserves that BreitBurn owns. The hybrid price of oil/gas was $35 a barrel at the time, which translated into an equity value of around $17 per unit. (Though, had BreitBurn actually liquidated and sold its reserves, it would take a haircut due to the time value of extracting the reserves over a period of years.) Distributable cash flow (profits that can be freely distributed to unitholders) totaled $2.70 per unit, $2.08 of which was actually distributed in the form of a dividend. So at a price of $6 per unit, we were purchasing BreitBurn at a yield of over 30%. This was clearly an asset with a large margin of safety.

We continued to purchase BreitBurn through the next quarter. Even with their hedges in place, cash flow did drop going into 2009 as demand for oil and gas continued to languish. Because of falling energy prices and asset values, BreitBurn’s lenders decided to redetermine their borrowing base (the amount of debt the company is allowed to have in relation to oil/gas reserves). Although BreitBurn was still in the “safe” zone, it was a hectic economic period with little liquidity, and management made the choice to temporarily eliminate the $2.08 distribution. This was a prudent decision, as they could instead pay down debt with their cash flow and eliminate the risk of having to raise new equity or refinance at a bad rate. It’s always better to be safe than sorry. This was one of the many excellent decisions that managers Hal Washburn and Randy Breitenbach made over the past few years.

On April 20, 2009, after the announcement of the dividend cut, BreitBurn’s stock price collapsed again under $6, and gave us another opportunity to buy more units. Our total average cost was $5.90. Over the course of the year, the price moved up steadily with the market. On February 8 of this year, they announced the reinstatement of the distribution at $1.50 per unit. “Yield” investors bought back in, pushing the share price to its current level of around $15 (a 10% yield). We sold a quarter of our position at $14, but BreitBurn remains one of our largest investments. Braewick Holdings LP currently has a long position in BreitBurn Energy (BBEP). We reserve the right to buy or sell shares at any time.