Warren Buffett's personal portfolio in the 1950s

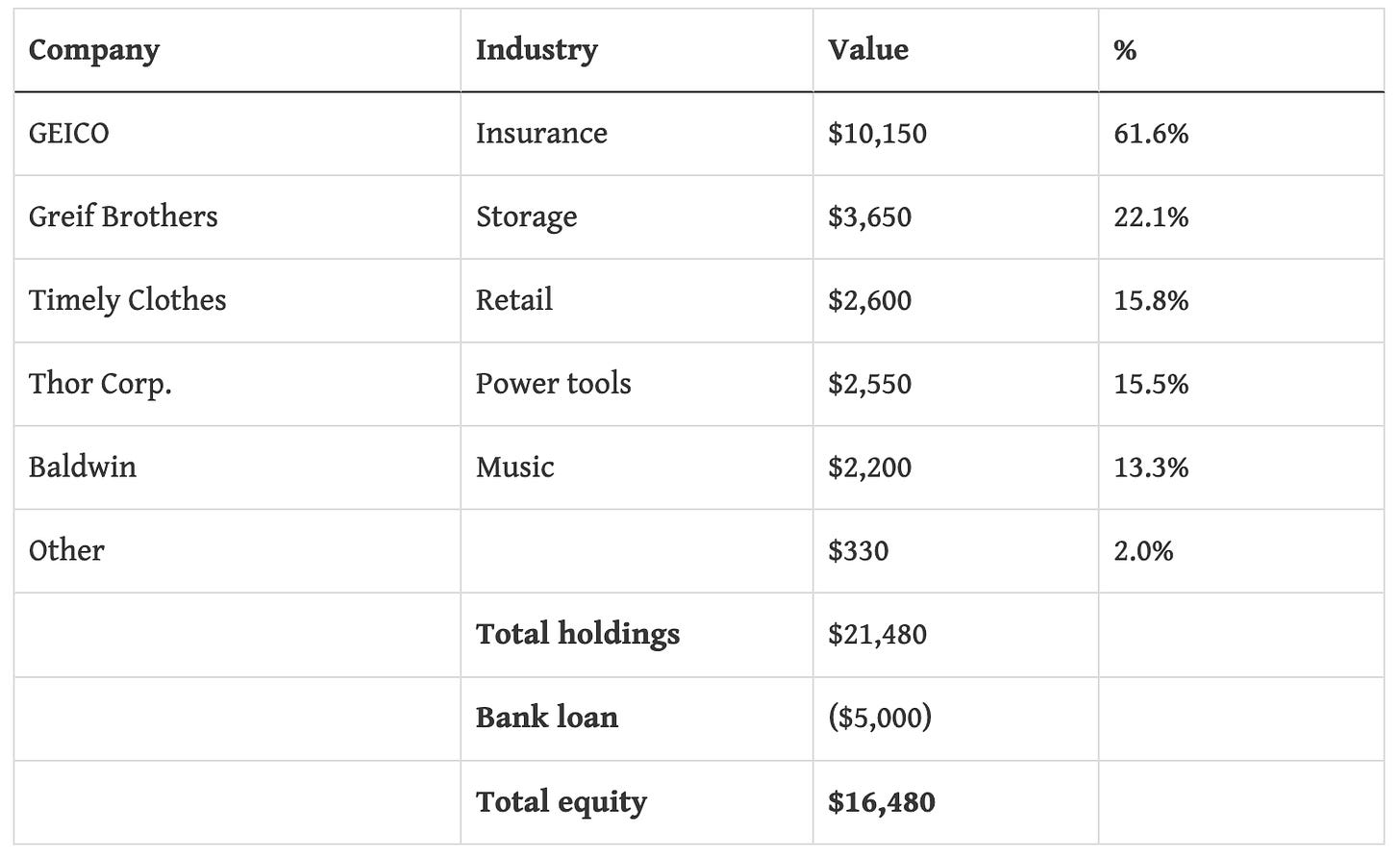

Here’s Warren Buffett's portfolio in the 1950s before he managed other people’s money: (courtesy of Robert Miles)

As you can see, he had about 130% in public equites with a margin loan of $5k. Nearly two-thirds of his portfolio was in GEICO stock. He must have had a lot of faith in his mentor Ben Graham!