Market Valuation Charts: 5/4/09

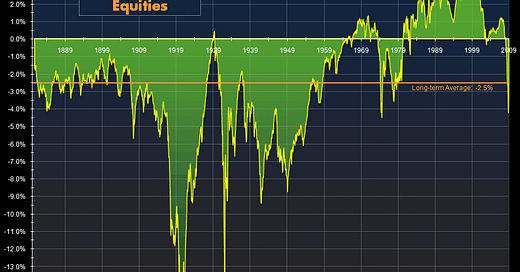

Chart: Bond Yield over Equity Yield. 10-year treasury yield minus inverse of Graham P/E Ratio (10-year average equity earnings yield). Current value: -2.8% (5/4/2009) Low value: -4.9% (3/9/2009)

Chart: Trailing 10-year return. Current value: -3.8% (5/4/2009) Low value: -5.9% (3/9/2009)

Chart: 10-year trailing Graham ("Real") P/E Ratio. Price of the S&P 500 divided by the 10-year average of earnings, inflation adjusted.

Current value: 16.1x (5/4/2009) Low value: 11.9x (3/9/2009)

One conclusion from the above charts is that based on the 128-year average, the market (as represented by the S&P 500) is fairly valued. (Data from S&P, Robert Shiller, and the St. Louis Fed.)

See also: Market Valuation Charts: 10/08