Apple Inc: The Greatest Turnaround in Corporate History

Some fun facts about Apple's turnaround:

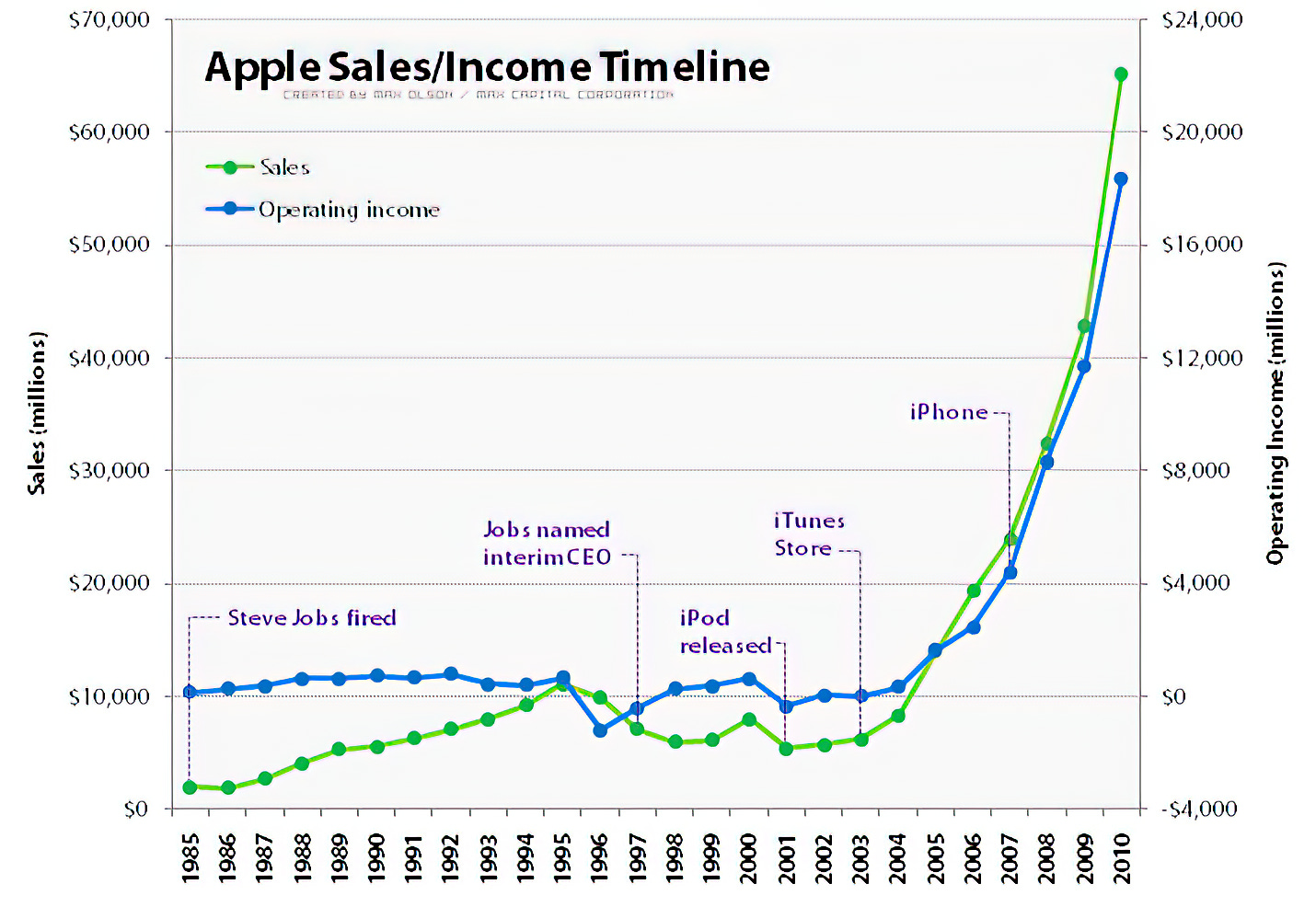

+8,524% (37.7% annualized): Stock performance since Steve Jobs' return to Apple in 1997.

+821% (18.6% annualized): Revenue growth since Jobs' return.

+5,093% (66.4% annualized): Stock performance since the launch of the iTunes Store in April, 2003. (A disruptive innovation.)

+951% (39.9% annualized): Revenue growth since iTunes Store launch.

In the last 8 years, revenue has grown by $60 billion (1,000%). 73% of that growth came from newly launched products.

In the last 3 years, revenue has grown by $40 billion (165%). 60% of that growth came from iPhone sales.

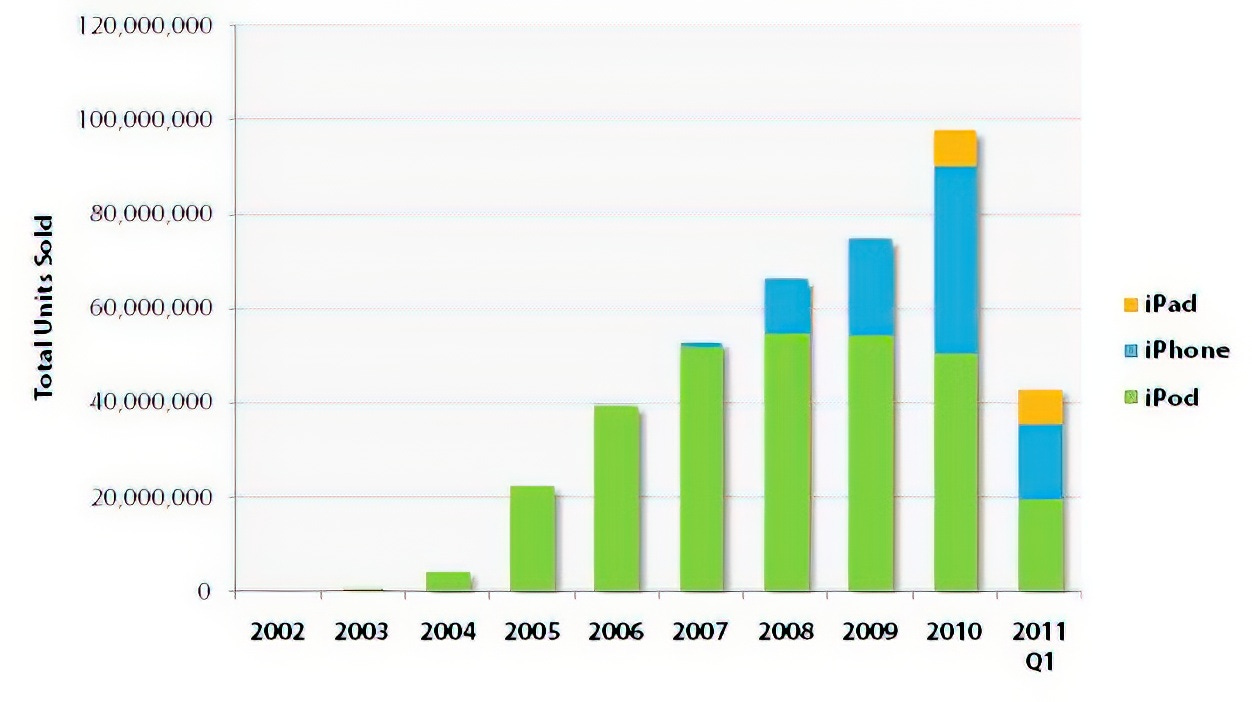

$220 billion: Amount of products sold since the release of the first iPod.

$19 billion: Apple's cut of all sales through the iTunes Store, plus Apple iPod accessories (currently $5 billion a year).

298 million: Total number of iPod units sold.

90 million: Total number of iPhone units sold.

If the cash and securities on Apple’s balance sheet (~$60 billion) was turned into a hedge fund, it would be the biggest in the world.

Apple Sales/Income Timeline

Apple’s unit volume for non-Mac products: