60 Years of Berkshire Hathaway Letters to Shareholders

New edition will be released October 14. Available for pre-order now.

I’m excited to announce the latest edition of my Berkshire Hathaway Letters to Shareholders book will be released on October 14. This will be the final edition of the book, covering all 60 years of Warren Buffett’s letters, from 1965 through 2024. It will be available on Amazon and from other booksellers.

A few numbers to tell the story: an $18 textile stock became a share worth $680,920 over six decades. That’s a 37,829x return, compounding at over 19% annually. The previous edition of this book has sold over 100,000 copies since 2013.

This format works because chronology matters. You watch Buffett’s thinking evolve without the distortion of hindsight. Quote compilations cherry-pick the highlights. The complete letters show you the dead ends, pivots, and gradual development of principles that became investing doctrine.

The letters document the transformation of a declining textile company with $25 million in equity into a trillion-dollar conglomerate. Buffett and Charlie Munger’s partnership drove this change, but the deeper story is cultural. They built a system that attracts exceptional leaders and compounds reputation into competitive advantage.

Physical books work better than PDFs for this kind of study. You can flip between years, cross-reference decisions, and mark patterns the way serious students should. Buffett keeps copies of this book in his office for exactly this reason.

This is the primary source for understanding capital allocation in practice. Business schools teach theory. These letters show how the world’s most successful investor actually thought through decisions as they happened. No academic interpretation, no journalist’s filter — just Buffett teaching directly.

If you already have the last edition from 10 years ago, here’s a list of the additions:

Latest 10 letters from 2015-2024

8 supplemental letters or appendices sent to shareholders over the years (like the letter about merging with Blue Chip and how to think of the valuation)

New forward written by myself

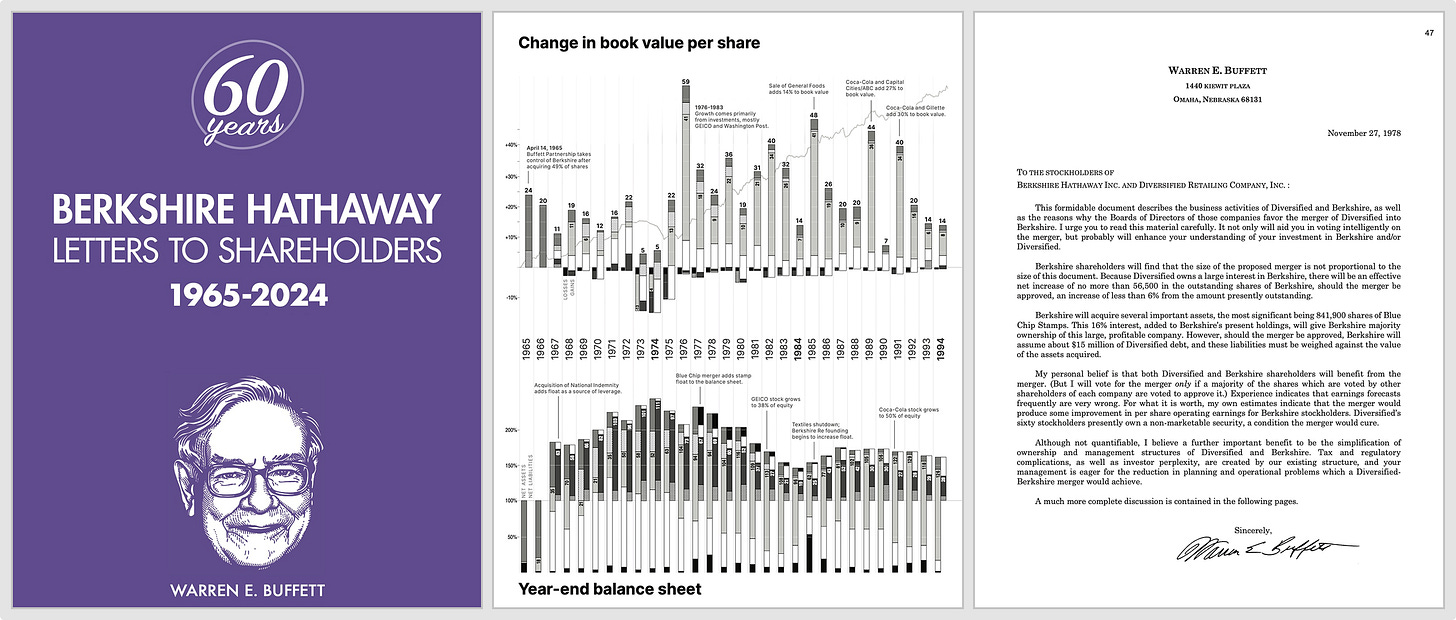

Detailed data visualization of annual change in book value + year-end balance sheet

The original agreement to publish these letters was done with a proverbial handshake (no contracts needed!). That’s how Berkshire works, and it’s part of why this collection matters. You’re not just reading investment strategy. You’re learning the principles that built one of the world’s most admired companies.

I’m grateful to have played a small role in spreading Buffett’s wisdom and Berkshire’s story. I hope that this final edition helps you become a better investor and thinker. The lessons in these letters will endure for generations.

Available for pre-order now, releasing October 14, 2025 on Amazon in hardcover and Kindle formats.

Congratulations on bringing this final edition to market! The 37,829x return over 60 years is staggering when you really sit with it - that's the power of 19% compounding without interuption. What makes this collection so valuable is exactly what you highlighted: the chronology reveals the evolution. Too many people want the 'greatest hits' when the real education is in watching Buffett navigate uncertainty in real time, make mistakes, and gradually develop the principles that seem obvious in retrospect. The handshake agreement detail is perfect - it embodies the Berkshire culture where reputation is currency. This will be an essential resource for serious students of capital allocation for decades.