Investment Idea: MAIR

MAIR Holdings (MAIR) - $5.17

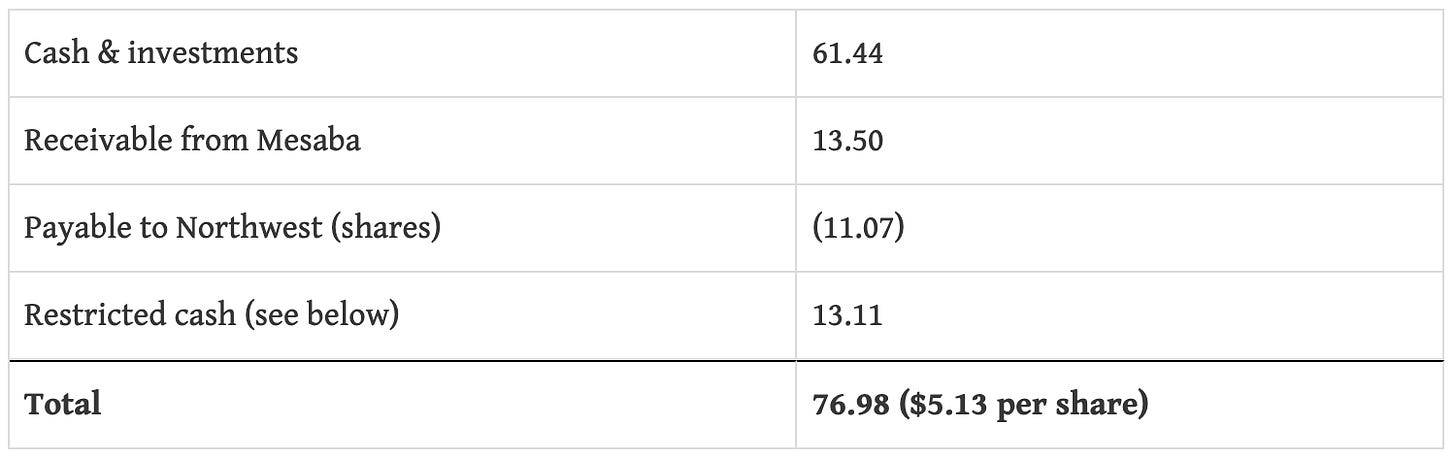

MAIR is a very low risk / high uncertainty opportunity that has identifiable catalysts to unlock value in a reasonable amount of time. MAIR is a holding company that at the moment owns a very small regional airline (Big Sky Airlines) but is a majority cash and investments. It previously owned Mesaba Airlines, which went bankrupt in 2005, and was subsequently sold to Northwest Airlines (NWA) in April of this year. The current valuation numbers are below: ($Millions)

I look at this value as the downside, assuming management doesn't do something stupid with the cash. There are two activist investors (owning over 14% of the company) pushing MAIR to distribute excess cash and sell Big Sky, so I'm hoping this helps things out a bit. The restricted cash account is collateral for a plane hangar MAIR guaranteed to Mesaba bondholders. As long as MAIR finds a sublessor for the hangar by March 2008, the $13mm will be released.

The upside

The opportunity lies in the value of Big Sky and the distributions MAIR will receive from Mesaba's bankruptcy. Because of stipulations in Mesaba's contract with NWA, during bankruptcy they received a claim worth $145mm, which they subsequently sold to Goldman Sachs for $125mm in cash. Since MAIR was the sole equity owner, creditors of Mesaba get their share ($90mm is the latest estimate), and MAIR will get whatever's left. The exact amount paid out is unknown, but Mesaba estimates the actual payout will be AT MOST $90-100mm. So MAIR's share will be $25-35mm.

The value of Big Sky is a little less clear—it has negative equity of $2mm and a history of operating losses. But I think there is value to a potential acquirer, especially with recent expansion initiatives. Recently, Big Sky started flying for Delta out of Boston. Even without the new business, sales have grown 25% over the last two years. Pinnacle Airlines (another larger regional carrier) just acquired Colgan Air (a very similar airline to Big Sky with operating losses and same sized planes) for 35% of sales. Using this and other metrics I obtained, I think Big Sky could be sold for a minimum of $10-20mm.

So, liquidation value is $77mm ($5.13/share), "low" value is $112mm ($7.47/share), and "high" value is $132mm ($8.80/share). This is a 1% downside, and upside of 44-70% from the current price. Like I said, there is some uncertainty surrounding the distributions, value of Big Sky, and what management will do with cash. But I think once they get the Mesaba distributions or the activists have any luck, the price should move to intrinsic value fairly quickly.

Disclosure: As of this writing I own shares in MAIR. This is not a solicitation to buy or sell stock in any company.

UPDATE (June 2009):

This investment was, to put it mildly, a complete failure. I don't believe the investing process was very good either. The premise of MAIR was very intriguing, but my estimates weren't nearly conservative enough and I didn't leave a large enough margin of safety to compensate. The liquidation thesis played out, as MAIR eventually ended up ceasing operations and returning the proceeds to shareholders. However, my valuation (even the downside) turned out to be too optimistic. There was a large amount of "winding down" legal and liquidation costs (too much in my opinion). Due partially to rising fuel costs, the economics of Big Sky airlines were not feasible, and not only did Big Sky not turn out to be worth anything, but it actually cost MAIR many millions of dollars before being shut down. I ended up losing about 30-40% on MAIR. Lesson learned -- even in a situation with identifiable tangible assets, it always pays to be too conservative.