On Wal-Mart Stores Inc.

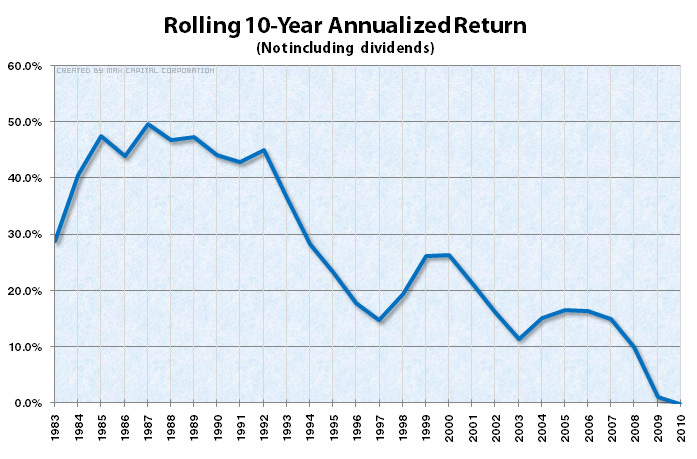

The following is a writeup I did for Wal-Mart on Sum Zero, included in its entirety below. Also at the end of the post are some charts that show how Wal-Mart has evolved over time. There is no doubt that Sam Walton and Wal-Mart are one of the, if not the greatest success story over the past 50 years. So it's a great case study to take a look at. (I believe Warren Buffett once said that his greatest error of omission was not investing in Wal-Mart, a business he could understand very well, in its early days--which is clearly seen in the charts below.)

Wal-Mart is often listed as a cheap large-cap, but is owned by surprisingly few value investors. One reason is that it’s big and well scrutinized and hence its price is more “efficient.” This is partly true, and you won’t get stellar returns investing in Wal-Mart. But it is a cheap, well-managed company that returns cash to shareholders and should fare well under a number of different macro scenarios.

Competitive Advantages

The U.S. stores division of Wal-Mart (about 3/4 of pre-tax profit) has significant competitive advantages. To consumers, Wal-Mart’s brand represents one thing: low prices. Customers in the vicinity of a Wal-Mart remain loyal because they can be certain that they will have the lowest prices. And as long as Wal-Mart doesn’t slack off in the service and facility departments, there will be no good reason for customers to switch.

Wal-Mart can have the lowest prices because of their (1) efficient operations and (2) economies of scale. Operationally, expenses are lower because of their non-unionized workforce and other shrewd cost management (shrinkage, inbound logistics, etc.). This penny-pinching mentality has been ingrained in the company since it was founded by Sam Walton. The biggest cost advantages are from Wal-Mart’s economies of scale. The most obvious consequence is purchasing power—Wal-Mart can buy products at lower prices because they can purchase in such enormous quantities. But the biggest and most un-replicable scale advantage is geographic concentration. Wal-Mart has a “hub and spoke” system of a distribution centers with 100-150 stores around them, all within about a day’s drive. Because of this concentration, costs can be distributed over a larger base of potential customers: distribution, advertising, regional management, etc. Wal-Mart also has some of the most technologically advanced merchandise and logistics systems in the world. This is something that smaller or more spread-out retailers can’t match.

Capital Investment

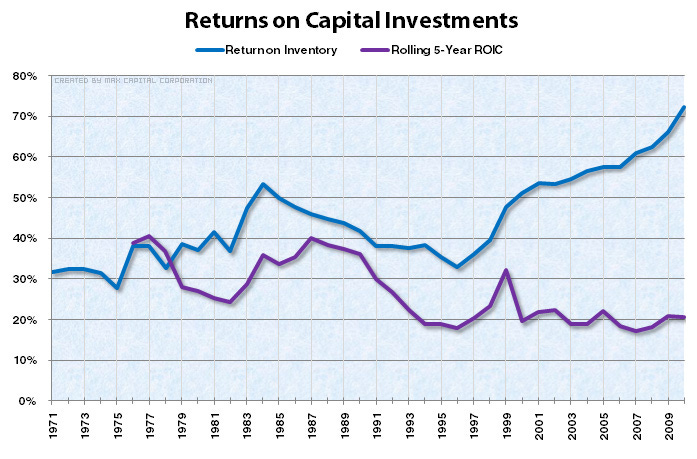

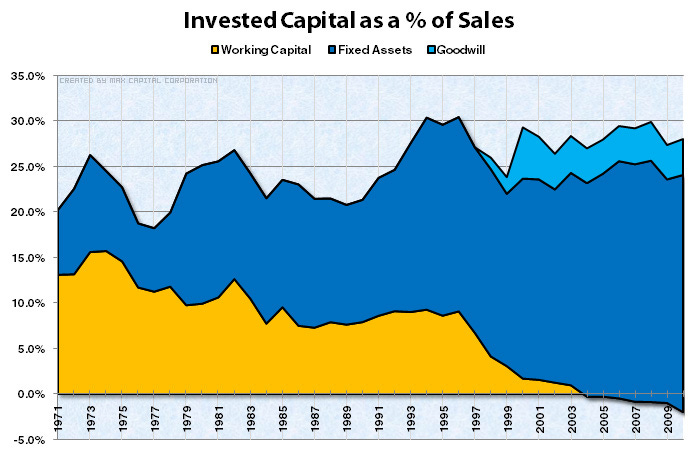

Wal-Mart has turned their inventory at a faster rate for each of the past 7 years. This is due to better inventory management and logistics, which have allowed Wal-Mart to decrease their inventory per square foot to around $35, giving them an inventory turnover of 12x. This compares to turnover of 13-14x for Costco and 9x for Wal-Mart a decade ago. Return on inventory (margins * turnover) is at an all-time high. This, along with a slightly higher payables period, has turned working capital into a source of capital instead of a use of it.

Recent pre-tax ROIIC (return on incremental invested capital) is about 20% for the entire company, which includes lower-returning international acquisitions. Figures aren’t broken out perfectly, but I estimate that ROIIC for the Wal-Mart Stores division is around 30% with the International and Sam’s Club divisions at 10% and 14%, respectively. These returns once again reflect Wal-Mart’s advantages in the U.S. and their troubles replicating those advantages overseas.

Valuation

Though the price has been up over the past 3 months, free cash flow yield on equity is still around 6-7%, most of which is returned to shareholders through dividends (2.2% yield) and share buybacks (2-3% a year). Current valuation is also lower than historic multiples. In fact, earlier this summer when shares hit $48, trailing EV/EBIT was 8.6x, the cheapest multiple Wal-Mart has traded at since 1985.

$55 * 3,636.5m shares + $37.8b net debt = $237 billion EV Trailing EBIT = $24.8b; EV/EBIT = 9.6x

Sum of parts valuation:

$33b – Walmex stake (Market value of $48b, 68.5% stake) $30b – Other International (10x pre-tax FCF) $14b – Sam’s Club (11x pre-tax, vs. 10x for BJ and 13x for COST) $240b – Wal-Mart Stores (15x pre-tax) ($38b) – Net debt $279b equity value ($77/share)

Growth

U.S. stores are still being reformatted and converted into Supercenters: the percentage of stores in the Supercenter format is 74% versus 28% a decade ago. Also, the Neighborhood Market (NM) concept, which is basically a stripped-down grocery store, is still slowly being rolled out. Both should take share from lower-end grocery stores, and grow square footage 3-4%/year with another 1-2%/year growth in sales per square foot.

As for location growth, it’s hard to picture that many more Wal-Marts in the U.S. But there is still some opportunity here. In their home state of Arkansas, there is one Wal-Mart store for every 32,000 people. With NM’s that number could probably go lower, but that’s just about saturated. A bigger state like Texas has about 66,000 people per store which I figure is a reasonable goal for other areas. To push California to that figure, they’d have to open around 400 stores. To push other states to that level would add another 900. Wal-Mart has historically had trouble with major metropolitan areas like NYC, but that may change as they experiment with NM’s and smaller store formats.

Most new growth for the overall company will come from the International division. Within International, organic growth in emerging markets (South America and China) offers the best opportunities. The biggest segment is Wal-Mart Mexico (Walmex), which now includes Central America, with 2,122 stores. Walmex’s operating income has more than doubled over the past 5 years to $2 billion, and is growing 13% a year.

The biggest risk here is achieving low return on investment in new markets, primarily in growth through acquisitions. They haven’t done well in that regard over the past 5 years, the reason being they have no real advantages in starting or acquiring new companies far from their dominant U.S. business. They recently made an expensive offer for Massmart, a dominant South African discounter, and are bidding on a retailer in Indonesia. Hopefully they will be more disciplined in the future regarding expansion into new areas overseas.

Number of U.S. Wal-Mart Stores:

Returns on capital investments: (return on inventory = EBIT margin * inventory turnover)

Invested Capital as a % of Sales: (You can see the more efficient use of working capital over time as well as the spike in fixed assets as they expanded rapidly outside their normal geographic area in the '90s.)

Historic End of Year and Low EV/EBIT: (Notice that, despite outstanding growth and financial performance, how cheap Wal-Mart was pre-1986.)

Rolling 10-Year Annualized Stock Returns:

Braewick Holdings LP currently owns shares in Wal-Mart Stores (WMT). We reserve the right to buy or sell shares at any time.