Repost: Tokenized Securities & The Future of Ownership

I’m currently working on a post about the Space industry — its current status, why growth is about to explode (in a good way), and future opportunities in the space. 🚀

In the meantime, recent trends and events have people talking about 2 related concepts: DeFi and NFTs. DeFi (decentralized finance) is a catch-all term for moving the finance stack onto the blockchain, in theory making it cheaper, more efficient, and more egalitarian. NFTs (non-fungible tokens) are unique digital assets stored on a blockchain that can be transferred or sold like physical property.

So in this edition I’m reposting an essay I wrote in 2018 on tokenized securities. In the nearly 3 years since I wrote it, a lot has changed and I haven’t been able to keep up with everything — but the main point still stands.

The GameStop/Robinhood fiasco was made much worse by the structure of the existing clearing house system, and many have called for DeFi to replace it. The diagrams below show how this can be done. NFTs have also become popular lately, with digital assets like art and collectables (CryptoKitties or NBA Top Shot). (In the breakdown of token types below, NFTs are “assets”.)

Onto the original post:

In the coming years, Tokenized Securities are poised to take over existing financial markets and create many where they didn’t exist before. This is only now possible due to the invention of decentralized blockchains along with the recent influx of interest and capital.

So what are they? Here are a few good resources to start with:

The Token Handbook — a comprehensive guide to tokens.

The Official Guide to Tokenized Securities — “If cryptocurrencies like Bitcoin are considered ‘programmable money’ then you can consider Security Tokens a version of ‘programmable ownership.’ ”

There’s plenty of related buzzwords like blockchain, crypto, ICOs, colored coins, etc., but forget all of those for now. Tokenized Securities are digitized, programmable ownership. Legal ownership requires enforceable scarcity. Normally anything digital isn’t scarce, but they can be thanks to decentralized ledgers (blockchains).

(A personal aside)

A bit of personal backstory: In 2014 myself and a few friends researched an idea for a company that would be a “broker” of sorts who legally managed stock certificates for companies of all sizes.

Customers would be able to programmatically start a company, allocate equity and other financial instruments to owners, manage their cap table, and trade shares on or off an exchange — all completely automated. This of course would be done via a blockchain of some sort: back then it was colored coins, side-chains, etc. The “assets” would be actual company shares, while the “liabilities” would be the tokens and their owners. This was a way to hack the existing rules around equity ownership.

I even gave it a name — Bloctree. Yes, I bought the domain too. (It’s much more disappointing when an idea goes nowhere once it has a name.)

The idea ultimately fizzled out as it dawned on us the technical and legal challenges of the venture. But the good news is that other startups currently have a great opportunity to do just this: Polymath, tZERO, Harbor, Carta, and more.

There’s endless potential

There are many benefits to widespread asset tokenization: better liquidity (more market participants at lower amounts), lower fees, less restrictions on trading, faster execution, automated governance/legal/accounting functions, and more. Anthony Pompliano goes into more detail in the post linked above.

What can be tokenized? Basically anything that can be legally owned, especially something that’s already bought and sold on some kind of market. There’s the usual suspects, and there’s assets that aren’t traditionally thought of as fractionally owned:

Corporate equity and debt — common stock, preferred, lines of credit, long-term bonds, etc.

Funds and investment vehicles — hedge funds, PE, VC, ETFs.

Real estate — commercial, residential, timeshare, mortgages.

Art

Commodities

Usage rights

Through programmed smart-contracts, potential restrictions and abilities will be built-in to tokens:

Voting/governance. Each holder receives a “vote” token that can be submitted to verify your proportional vote, and expires at a certain time. Certain tokens could act as share classes and allow more votes or preferential treatment, including liquidation preferences.

Automatic vesting. Certain percentage of tokens are locked to prevent trading and expire worthless unless confirmed by a central authority or intermediary.

Dividends. In the form of cryptocurrencies or fiat if on a brokerage or centralized exchange.

Tenders, buybacks.

Spin-offs. Each token holder would be “airdropped” tokens of the new spin-off.

Options.

Lockup periods.

High-water marks and different fee structures for funds.

There are also plenty of things that tokens enable that aren’t possible with traditional securities. A few examples:

Within a larger company, easily create new tokens for subsidiaries or projects owned by the parent that can be spun-off or kept internal and used for incentive compensation.

Any shareholder who owns over a certain amount of tokens automatically receives a ticket to an event (conference call or meeting).

Product discounts for ownership. A more automated version of what Berkshire Hathaway does for GEICO, NFM, etc. Shareholder of Apple? Get a discounted Apple Music subscription.

How will it work?

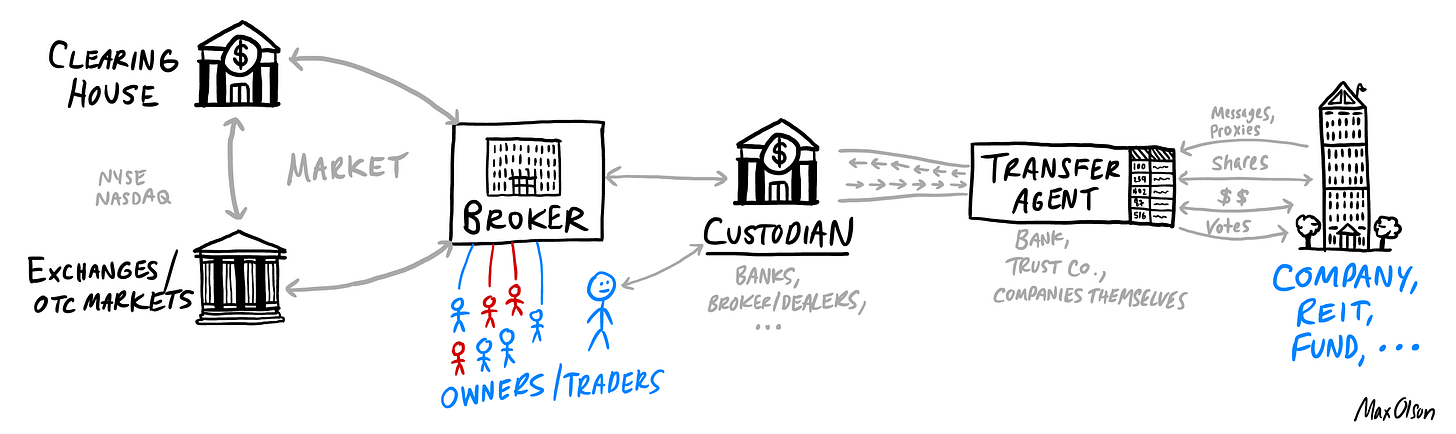

The above diagram shows roughly how current public-market ownership works. A Company forwards all shares, capital raises, communications, and votes through a Transfer Agent. A Custodian keeps track of physical or digital shares for owners. A Broker buys or sells shares for investors on an Exchange (like the NYSE or NASDAQ) which also needs a Clearing House as a middle-man to help match and settle trades. Keep in mind that even this diagram is simplified, and in reality there are multiple other components.

With tokens replacing shares on a distributed blockchain, the following setup is now possible. No more middle-men: a company can distribute shares, money, and verified communications directly to owners.

This is likely how a small company with a handful of owners would work. The company or asset manager could use an application that helps manage their token “cap table.” They can sell new tokens to investors presuming legal compliance. They can send proxies or other communications, and handle votes.

Once the asset being owned gets bigger — higher value, more owners, more trading — middle-men will enter the picture again. A Digital Custodian will “hold” the tokens for investors (like CoinBase does for currencies) and help manage communications and voting. The same service could also act as a Broker, helping to facilitate trades on some sort of Exchange, whether a traditional one or decentralized.

Many practicalities still have to be worked out

How does share issuance currently work? Recent companies attempting to tokenize have done so through a legal “hack”: issue traditional paper shares and bind them through a legal agreement to a fixed amount of tokens, similar to the method I described above that we planned on using for Bloctree. This is essentially a “promise” to maintain a 1-to-1 relationship between shares and tokens, using the blockchain as a share registry/transfer agent.

As I was writing this post, Delaware corporate law was changed to allow for blockchain-maintained share registries. This change is a good start. There are still many restrictions on it but these are likely to adapt over time. It’s also unclear exactly how it will work in the real world. The ERC-884 token mentioned in the post linked above is still just a proposal.

What are tokens built on? Most tokens are built on the Ethereum protocol but this could also change down the road. Once a successful decentralized blockchain like Ethereum exists, the key will be integration with securities laws and regulations. The R-Token is a recent example built on the original ERC-20 token.

There will be no crypto utopia…

Many promoters tout tokens and crypto as a panacea. That they’ll lead to some kind of utopia where there’s no gatekeepers, everything is decentralized and just “happens” magically. This is a more specific — and less likely to work — version of the “markets fix everything” idea.

Tokenized securities will not change everything. The true nature of business, economics, investing, and valuation will all stay the same.

… but tokenized securities are the future

Tokens and crypto have huge potential to revolutionize markets and change the way capital is allocated. They’ll make ownership cheaper, easier, more liquid, and more democratized. They’ll also enable features never before possible through existing technology, laws and business models.

Consequences will be similar to the invention of the corporation, stock exchanges, or double-entry accounting. Imagine receiving funding as easy as using Venmo, or giving out equity by sending an email.

I strongly suggest anyone in the business or finance world follow the progress of tokenized securities. Understanding all the technical details isn’t necessary (I don’t either). Exactly how the change will happen — and how fast — we’ll have to see. But I eagerly await watching and participating in the change. If history is any guide, we still have many more years of “wild west” experimentation ahead of us.