Instacart: analysis of a startup

Instacart is a seed-stage startup that delivers groceries and other basic items in a very short timeframe. They are the "Amazon.com with a 1 hour delivery." At the moment their current market is only San Francisco and the Silicon Valley area. Customers can place either a 3-hour order ($3.99) or a 1-hour order ($14.99). Orders are routed to shoppers who work for Instacart, who then pick up the items at a local store and deliver them within the timeframe.

In October they raised $2.3 million from Canaan Partners and Khosla Ventures. Below is a a very brief analysis if I were considering a potential investment in Instacart.

Quick analysis

So basically Instacart uses software (algorithms & data analysis on the back-end, with good UI design on the front-end) to connect "deliverers" in need of cash with "buyers" who need quick delivery of basic items.

Opportunity: arbitraging the demand for instant satisfaction and convenience, using software + crowdsourcing. This will be disrupting convenience stores on the low-end, and potentially grocery stores in the future. It is taking advantage of the trends in mobile computing, data analysis, and e-commerce (willingness to trust online vendors).

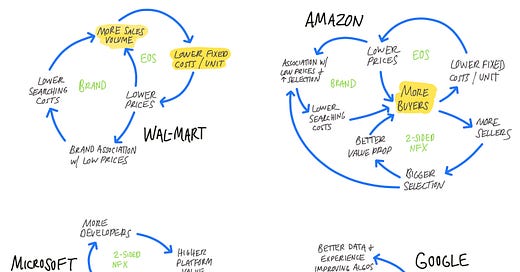

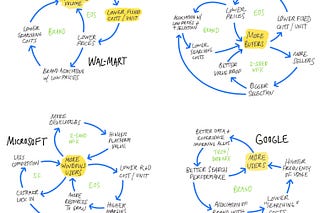

Potential moats: brand habit developed through repeated purchases. Learning curve — should remain ahead of competition on the learning curve because of technology (software) advantage. This is a business where it pays to have lots of data on: customer habits, traffic, prices, store traffic, etc. It is a virtuous circle: the learning curve reinforces customer experience, which improves the brand. These advantages are all geographically local, so it will be best to roll out to new cities as quickly as possible once the kinks are worked out.

Management: with only doing minimal due diligence with public information on the founders, I didn't see any red flags. Apoorva Mehta has worked on the Amazon supply chain, so he has some experience in the business. All founders on the surface seem to be very talented. What am I looking for? Amar Bhide found that the most important traits for the founders of a typical startup are the dichotomies of: (1) seeking uncertainty while being risk averse; and (2) persevering while being adaptable.

What could go wrong: (1) other cities are not as receptive to the concept; (2) Amazon or other grocery company catches on and preempts their growth in new cities.

Investment edge: structural (not very many participants at this early stage) and psychological (grocery delivery has failed many times in the past, sometimes spectacularly — Webvan — investors are turned off by the concept because of these past failures).

Final note

This seems like a company with a good future ahead of it. That usually makes it a good investment, especially at this stage. I'm not sure what the valuation of the company is at the moment. But for a startup at this stage, the precise valuation you invest at isn't usually as important as how well the company does (within limits, of course — refer to the internet bubble).

Disclosure: I have no ownership in Instacart.

References:

Crunchbase: Instacart Mobile first, desktop second... I Trusted a Total Stranger to Buy My Groceries... Instacart Bags $2.3M To Become Amazon of Groceries How Instacart Hacked YC